Guide to car insurance claims

All you need to know about making a claim.

What To Do When You Are Involved In An Accident

KEEP CALM

Do not admit you are at fault

Do not agree to offer or settlement

Do not sign anything

Call Road Assist

Call “Insurance company” Road Assist helpline to ask for assistance

Refer road tax sticker printed Road Assist Helpline Number . Example:

Gather Evidence

- Note the place and time of the accident

- Take photos of accident scene and damaged to vehicle involved

- Exchange information with the other party:-

Driving license number, contact number & address

Vehicle model, registration number, Insurance Company

Report

Lodge a police report within 24 hours of the accident. Late reporting can result in a fine.

Notify

Notify Setia Risk or the insurance company within 7 days of the accident.

Please Call : +607-2528816

Whatsapp : +6012-7091202

Repair

Send the damaged vehicle to Panel Workshops or to the franchise’s panel repairers.

Supporting Documents to Submit

If the accident was your fault, make an OWN DAMAGED CLAIM

- Completed claim form

- Completed electronic fund transfer (EFT) form

- A copy of police report

- A copy of insured’s NRIC

- A copy of driver’s NRIC and valid driving license

- A copy of vehicle ownership certificate (VOC) with full JPJ search

- Photograph of road tax

- A copy of hire purchase agreement

- Photograph(s) of the scene of accident

- Summons issued by the police

- Information and documentary evidence as may be required by insurer or adjuster

If the accident was NOT your fault, make an ‘OWN DAMAGED Knock-For Knock’ claim

- Completed claim form

- Completed electronic fund transfer (EFT) form

- A copy of police report

- Police report of the third party

- A copy of insured’s NRIC

- A copy of driver’s NRIC and valid driving license

- A copy of vehicle ownership certificate (VOC) with full JPJ search

- Photograph of road tax

- A copy of hire purchase agreement

- Photos of accident scene and damaged to vehicle

- Police letter informing which party is compounded for road traffic offence

- JPJ search of third party vehicle particulars

- Completed Claim Form

- Completed electronic fund transfer (EFT) form

- Police Report

- Original Registration Card

- Original Policy and Certificate of Insurance

- Copy of hire purchase agreement

- A copy of Driver’s Identity Card or Passport

- A copy of Driver’s Driving License

- A copy of Insured’s Identity Card or Passport

- A copy of Insured’s Driving License

- Full set of keys to vehicle

- JPJ K3 Form duly signed by Insured

- Completed JPJ Lampiran A ’1’ – Letter of Indemnity

- Completed Lampiran B – Borang Akuan

- Letter of Release from hire purchase or finance company if applicable

- Certified copy of Memorandum & Article of Association (for limited company)

Panel Workshops

Windscreen Claim Procedures

Make a police report within 24 hours.

If the loss or damage is due to theft, burglary or malicious damage.

Please send your car to Insurance Company’s Windscreen Panel Specialist/Panel Workshop/Franchise’s Panel Repairers.

No payment required if the replacement cost is within your Windscreen Sum Insured.

Supporting Documents to Submit for Windscreen Claim

- Duly signed & completed windscreen claim form

- Driver’s NRIC and valid driving license

- Original invoice for tint film (if any )

- Original police report (If the loss or damage is due to theft, burglary or malicious damage)

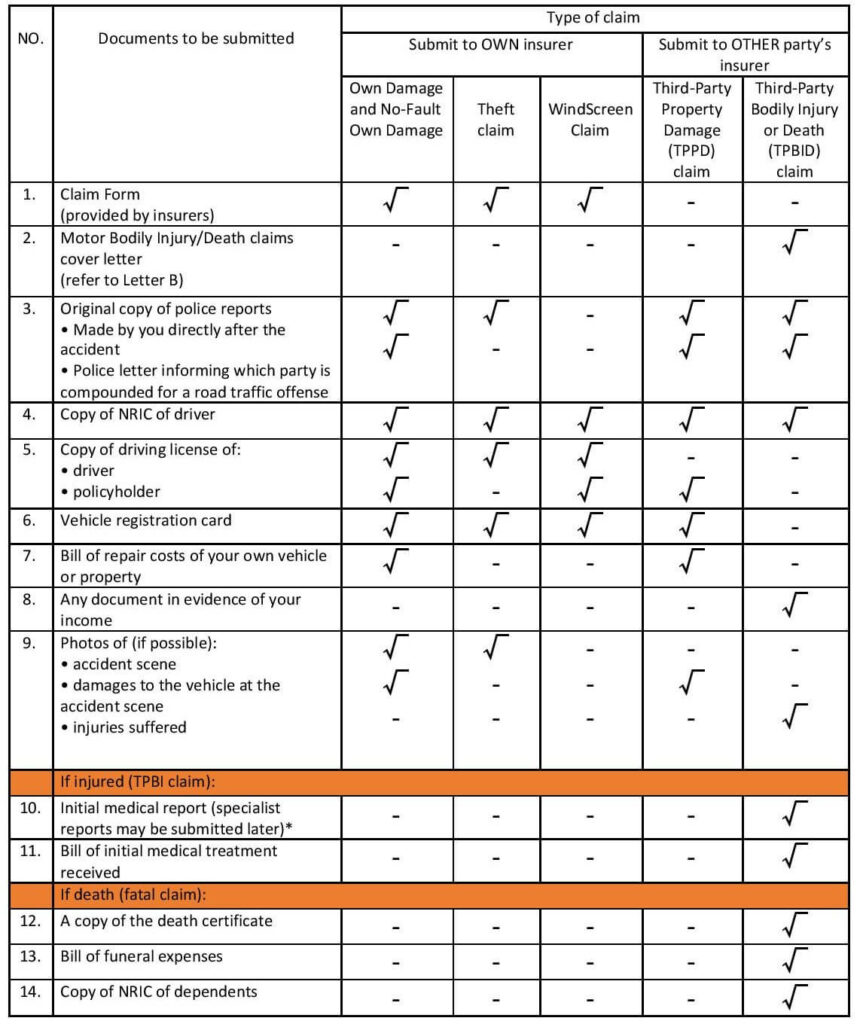

Required Documents at a Glance